If you’re not yes you can keep and make the mortgage repayments, be sure to comprehend the outcomes you to definitely bypassing it might has actually. ( iStock )

While a homeowner, you understand one missing your own homeloan payment is a significant price. Not just try later or non-payments probably end up in lingering phone calls out of your bank, however, a belated percentage might apply to your credit score. The newest emotional and you may emotional toll recently money tends to make dealing toward past year’s fret even more complicated.

To prevent missed payments that have a choice alternative like forbearance or a good refinance might be better than skipping your own payment per month totally.

While worried about destroyed an installment and want to consider a refinance, you could discuss your financial re-finance options by going to Legitimate to help you evaluate cost and you can loan providers.

It depends. If the percentage is later, it may not apply to your credit rating anyway. Certain lenders waiting at least 1 month before entry later commission information to help you credit bureaus. If you can compensate your own overlooked homeloan payment quickly, you should be fine. Yet not, if for example the payment is over 29 to 60 days late, it can likely appear on your credit report. Should your fee is more than ninety days late, the lender could pursue foreclosures.

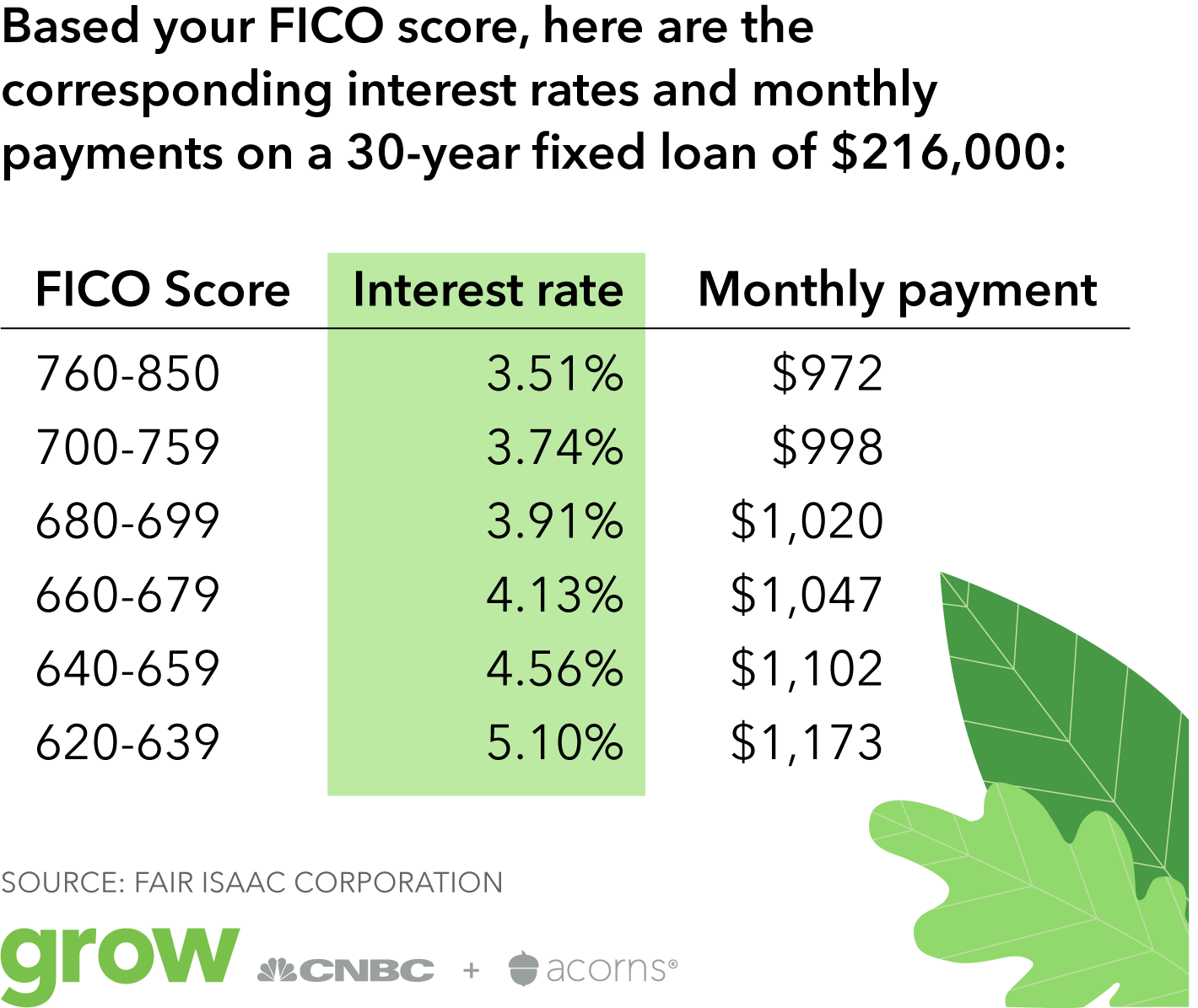

On-date costs make up about thirty five% of total credit score. When you yourself have a track record of late repayments, this will lower your credit history. All the way down fico scores allow it to be difficult to qualify for most funds.

According to FICO, a single overlooked percentage you’ll miss your credit rating by the 50 issues or higher on 31-big date mark. When your late fee is at 90 days, the latest score you’ll check out nearly 2 hundred affairs. The kind of borrowing from the bank, debt-to-income proportion and borrowing from the bank many years make a difference to simply how much destroy a solitary overlooked commission will have on your own score as well.

Your own lender helps you sign up for forbearance and you can/or stop foreclosure process

If you know you won’t help make your mortgage payment, label your own lender as soon as possible. For those who have one mortgage that’s backed by Fannie mae and you can Freddie Mac computer (FHA, HUD, Virtual assistant, USDA, an such like.), you happen to be legally permitted coverage through the CARES Act.

As an alternative, you could potentially speak to your lender just before a belated commission and inquire all of them having a great deferment. Good postponement allows you to disregard an installment and you can put it into the avoid of your own loan rather than affecting your borrowing from the bank score.

If you would like lower your monthly installments on the enough time identity, consider refinancing your home mortgage. Having interest rates nevertheless notably lower than usual, refinancing your home mortgage will save you a king’s ransom.

In case your loan is now in the forbearance, you can also qualify for an excellent re-finance if one makes on the-time money for at least 90 days pursuing the prevent regarding their forbearance.

Since overlooked costs apply at your credit score, you really need to submit an https://paydayloancolorado.net/cortez/ application for a good re-finance in the future for individuals who welcome one to you simply will not manage to continue while making your existing money.

You can use Credible’s online device to research different mortgage re-finance lenders to check out exactly what your loan options are, all of the versus impacting your credit score.

Hundreds of thousands have previously cheated financing forbearance or opted so you’re able to refinance their money to help you a lowered rate

The common 30-year fixed-rates financial was step three.17%, a growth out of .08% out-of last week and you may a good .33% elizabeth go out just last year. The average 15-year repaired-rate home loan is actually dos.45%, a rise of .05% out of the other day and you may a reduction of .47% regarding earlier year.

Should you decide to try to get a good refinance, definitely use an internet financial calculator to choose their the fresh month-to-month costs which have a re-finance.

Of a lot Us citizens is impact a monetary pinch in 2010. If you find yourself not able to help make your fee, you really have alternatives. Call their lender to discuss forbearance or visit Legitimate discover touching knowledgeable mortgage officers and then have your own financial inquiries replied.