Firstly, a keen NRI is approved to apply for a mortgage in India whether they have a legitimate Indian passport. As well, its earnings must be won from a resource external India and you can need become remitted in order to India from financial channel. A keen NRI should give proof of house in the country he could be residing in.

Secondly, NRIs need to meet the qualification criteria set of the Indian banking companies. Banking institutions usually assess the applicant’s creditworthiness, together with the installment strength and you will earnings top. Brand new candidate should have a great credit rating and may not be placed in the credit bureaus.

Finally, NRIs ought to provide enough collateral so you’re able to support the mortgage. This may are property or other assets for example shares, securities, or fixed places. The brand new candidate must possess a guarantor that will be stored responsible in case there is standard.

Finally, NRIs must pay running costs and other charges applicable to your loan. These include stamp duty, registration charge, etc. Likewise, NRIs must pay highest interest levels versus citizen Indians considering the greater risk from the all of them.

In conclusion, NRIs will get a mortgage within the India given it satisfy the new eligibility criteria and are also able to supply the necessary data and you may guarantee. They have to additionally be happy to shell out highest rates of interest.

Exactly how much mortgage is a keen NRI enter India?

A keen NRI (Non-Citizen Indian) could possibly get a home loan from inside the India once they meet up with the qualifications criteria put of the finance companies and loan providers.

Just as much loan you to an NRI can also be avail is based into the NRI’s money, payment potential, worth of the house or property becoming ordered, in addition to lender’s policy. Basically, extremely loan providers offer up so you’re able to 80-90% of the house worthy of since the financial to help you NRIs.

For the reason that an enthusiastic NRI’s credit rating is not available in India, therefore lenders become more careful when offering a loan to help you an enthusiastic NRI. On top of that, foreign exchange movement ount, thus loan providers charges a top rate of interest to make sure their funds is safe.

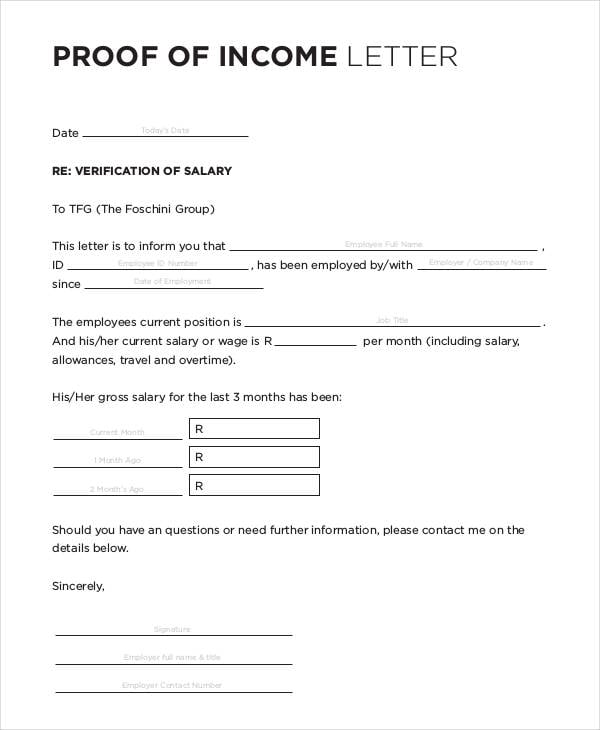

In terms of qualifications standards, an NRI have to have a legitimate functions charge or quarters permit and should have the ability to offer evidence of income, such income slides, bank statements, and you will taxation statements.

Files associated with the house or property becoming ordered, eg name deeds, product sales arrangement, and you can stamp obligation invoices, also needs to be provided. While doing so, loan providers might need a keen NRI borrower to include a safety put, including a predetermined deposit or life insurance coverage.

In conclusion, an enthusiastic NRI is also avail doing 80-90% of the property really worth since a home loan inside India. Although not, the interest rate might be higher than to own residential loans, and NRI have to satisfy certain qualifications requirements in advance of they are able to incorporate.

Carry out Indian financial institutions promote financing so you can NRI?

These financing are for sale to several motives such as for instance buying a house or flat, purchasing a motor vehicle, investment higher education, as well as for other private otherwise organization demands.

Brand new applicant should provide facts about their earnings, property, debts, and credit rating. The bank will measure the applicant’s financial situation to choose if they pay the financing. If the accepted, the bank tend to set a cost plan and you can rate of interest.

Also bringing financing so you’re able to NRIs, some Indian banking institutions supply special bundles designed towards needs out-of non-people. Like, there may be lower interest rates, expanded cost episodes, otherwise a lot fewer fees from the mortgage.

Extremely Indian finance companies need your applicant have a current account together before capable apply for a loan. Concurrently, the new candidate have to have a valid charge and you can an Indian address. This new applicant must have loans Calhan the ability to provide proof sufficient financing to pay back the loan.

Total, Indian banking institutions perform render financing to help you low-people. However, applicants is to meticulously think about the regards to the borrowed funds making yes they understand every standards and you will charges for the it prior to signing one documents.

Should it be a good idea having an NRI to track down home financing in the India by way of an Indian lender utilizes several circumstances.

To begin with, it is important to think about the cost of these financing. NRIs may find you to definitely interest levels into the home loans for the India try more than those in their residence places. They have to also be familiar with new repayment small print lay by bank.

Additionally, NRIs should think about whether or not they gets a reliable earnings stream used while making typical repayments toward mortgage.

The second grounds to adopt ‘s the coverage of one’s financing. NRIs is always to research the Indian bank operating system in addition to guidelines ruling lenders in the India.

This will help them understand the dangers associated with the taking out fully such as for example a loan, and precautions pulled from the financial so you’re able to protect the loan.

Fundamentally, NRIs must look into the brand new tax effects of taking right out property financing from inside the Asia. They have to look for expert advice into the prospective income tax effects of taking out fully financing from inside the India, also other monetary matters connected with the loan.

To summarize, while there are many different positive points to taking right out home financing during the India compliment of a keen Indian lender, there are also several dangers involved.