If you’re not positive that you could make the necessary costs, this may be could well be better to hold off and you can reassess your options.

- When would you like the work done? If not have to do brand new developments immediately, it can be value prepared and saving upwards some funds so you’re able to financing area, otherwise most of the, of one’s really works. Waiting prior to taking away a loan may also allow you to change your credit score and you will improve your odds of delivering a financing having a reduced rate of interest.

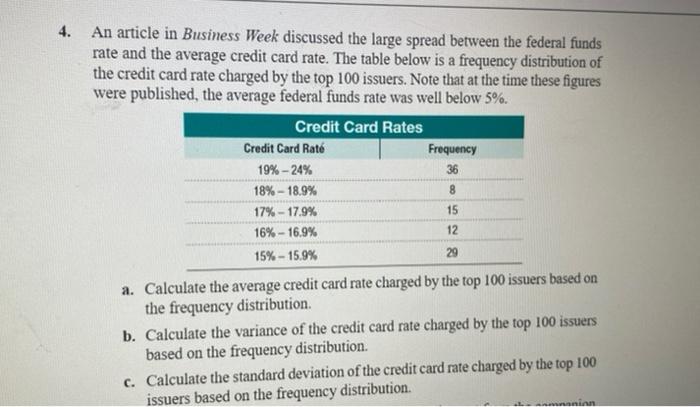

- How much does the task prices? Make fully https://paydayloanalabama.com/holt/ sure you get several rates for the renovations you do not spend more than-the-chance and that means you understand how much you need to use. You need to just borrow extent you need and never capture aside a more impressive mortgage even though you may be qualified.

- Read the corporation you plan to use is reputable and you will entered doing the required work. To reduce the possibility of difficulties in the future that could become costing you more currency, make sure you carefully browse providers to make sure they’re licensed to accomplish the work.

- Just how much can you afford to pay per month? You will want to exercise a spending budget observe what you are able easily afford to pay-off. This will help you find out how much you might obtain and how much time you will want to build costs. However,, new expanded the definition of, more you might pay inside appeal full.

- Have you compared lenders? It’s best examine some other loan providers to find the best mortgage for the problem. You can also fool around with a qualification provider that looks within multiple loan providers observe what fund you can be eligible for.

- Have you thought about solutions so you’re able to financing? Taking out financing to cover renovations might only often be the best choice. There are many more sourced elements of money that you may consider alternatively away from financing, particularly a charge card.

- Are you improving your home’s energy savings? Therefore, you’re able to find a loan having a reduced speed or perhaps qualified to receive capital from your own times provider or regional council, such as for example.

Family and friends

When you have one nearest and dearest otherwise family which can manage so you can provide your some funds, it can be worthy of inquiring all of them for a loan. But, although this might be a less costly choice than taking out fully a beneficial official financing, it’s just not a decision which should be taken gently.

You need to know new affect the mortgage have in your matchmaking and you will exactly what could happen in the event that something aren’t effective aside. Placing the loan agreement in writing, including the terms of cost and what will happen if you’re unable to repay the borrowed funds, normally reduce the probability of things heading wrong subsequently.

Make sure you simply use of someone you know and you can believe. Keep clear if someone else offers you that loan because they could be an illegal loan-shark.

Handmade cards

For people who only need to borrow small amounts to have a short amount of time, you can consider utilizing a credit card to invest in the necessary really works.

There are many card providers offering reduced otherwise 0% desire periods towards instructions otherwise transfers of balance but keep an eye on the deal prevent dates once the, for individuals who continue to have a great obligations on your cards after this date, you can end up using much more appeal than you’d to your a simple loan.

Remortgaging

If you wish to obtain a bigger number along with home financing on your domestic, you may also imagine remortgaging.