Older Home Lending Coach

If you’ve discover the ideal household or you happen to be just looking, reviewing readily available recommendations programs makes it possible to setting a technique for instant same day payday loans online Alaska moving on.

Fixed- Rates Mortgages: A fixed-rate home loan has the benefit of a routine interest rate as long as you have the mortgage, instead of an increase one adjusts or floats to the business. A normal rate of interest means their idea and attention percentage will continue to be uniform too.

Adjustable-rates Home loan (ARM): An arm mortgage is interested rates one stays a comparable having a flat time frame, following changes to help you a variable price you to definitely changes yearly. Particularly, an effective seven/6 Case has an introductory rate of interest to the very first seven years and then resets every six months upcoming on the left mortgage term.

Identity Duration: The duration of the borrowed funds have a tendency to impression your own payment per month. Eg, the fresh less the mortgage term, the greater you likely will shell out each month. Because you mention alternatives, think about your down-payment, the monthly funds and you will package properly.

Fixed- Speed Mortgages: When you’re fixed-speed loans promote a stable mortgage repayment, they often enjoys a higher interest rate. Because you consider your options, you may also question, “Is it my personal forever house, or simply a location where I will real time for most ages?” Which can help you know if a predetermined-speed mortgage is right for you.

Adjustable-speed Mortgage: If you’re you’ll likely spend less interest rate within the introductory several months, your own payment you’ll improve dramatically once this period comes to an end-maybe hundreds of dollars 30 days. Speed caps limit the matter their rate of interest can also be increase, however, make sure to understand what their maximum fee could be.

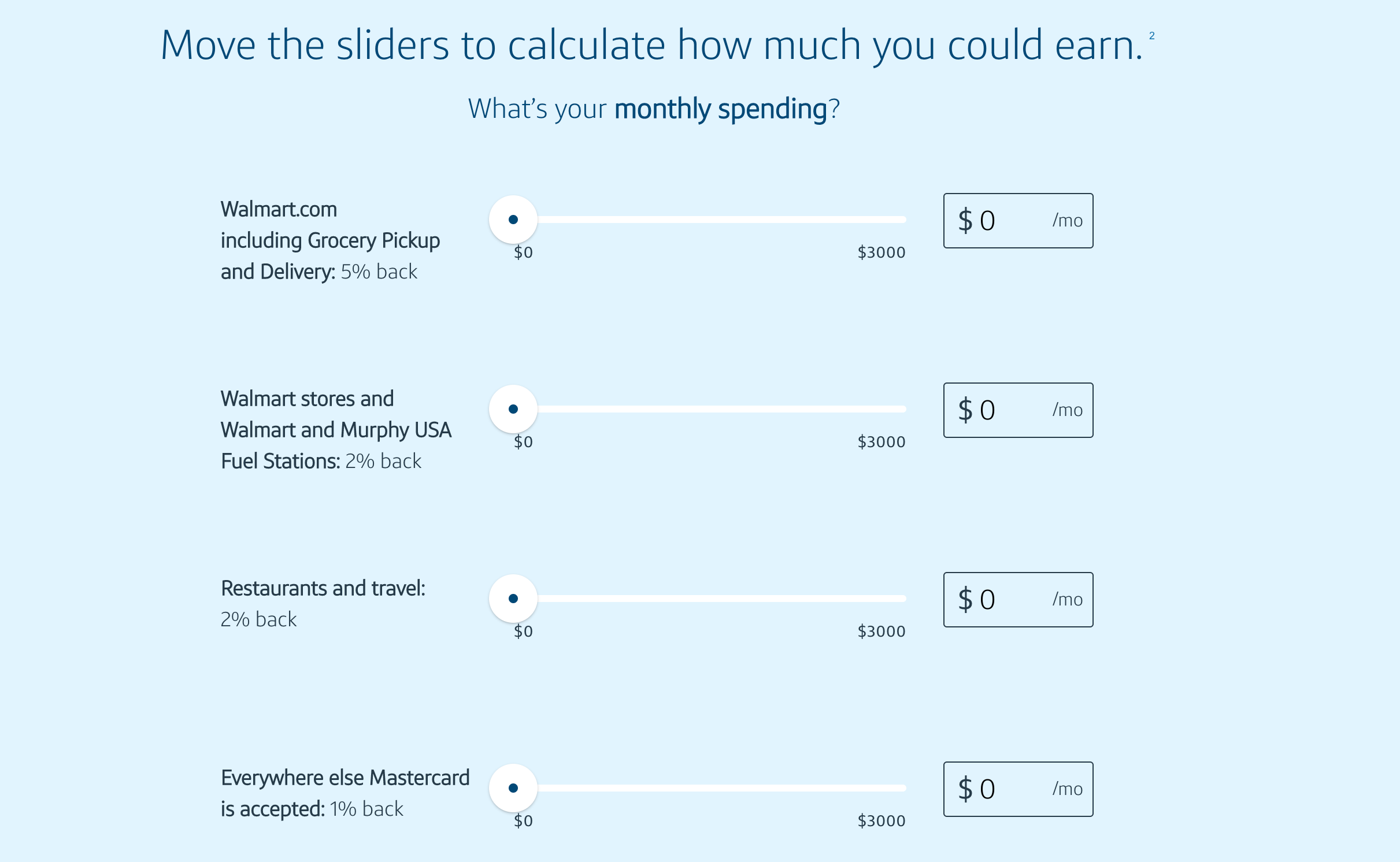

step 1. Units and you will hand calculators are provided due to the fact a complimentary to imagine your own financial requires. Abilities found is actually rates only. Talk to a good Chase House Financing Coach for much more certain pointers. Message and research prices may use from your supplier.2. Towards the Variable-Price Mortgage (ARM) tool, attract is fixed to own a set time period, and you can changes sporadically thereafter. At the conclusion of this new fixed-speed months, the interest and costs get raise according to upcoming index costs. Brand new Annual percentage rate could possibly get raise following loan closes.step three. Fund up to 85% off an excellent residence’s worthy of appear towards a purchase or re-finance without cash back, susceptible to assets sort of, an important minimal credit score and you can the absolute minimum number of month-to-month reserves (we.age., you need to reserved adequate cash in set aside and work out an effective given level of month-to-month mortgage payments principal, interest, taxation, insurance coverage and you can assessments following the mortgage closes). Product constraints apply. Jumbo finance readily available up to $9.5 million. Getting mortgage number more than $3MM (otherwise $2MM to have investment services), customers need to meet blog post-closure investment criteria to help you qualify. More limitations can get incorporate. Delight get in touch with a beneficial Pursue Family Credit Coach to have facts.cuatro. The brand new DreaMaker home loan is available without-cash-out re-finance out of a primary residence 1-cuatro unit possessions having 30-12 months repaired-rates terminology. Money constraints and you can homebuyer training course will become necessary when most of the home loan candidates is actually first time homebuyers.5. FHA finance wanted an upwards-side financial insurance premium (UFMIP), which are often funded, or paid at closing, and an FHA annual financial premium (MIP) paid back month-to-month might implement.6. Experts, Services professionals, and you can people in the latest National Guard or Set aside are qualified for a financial loan secured because of the You.S. Service out of Seasoned Items (VA). A certification out-of Qualification (COE) regarding the Va is required to file qualifications. Limitations and constraints pertain.7. A preapproval is dependant on a look at income and advantage suggestions your render, your credit history and you may an automated underwriting system comment. Brand new issuance off a great preapproval letter is not a loan partnership otherwise a vow getting financing approval. We could possibly provide a loan connection when you sign up so we perform a last underwriting feedback, along with confirmation of any information given, property valuation and you may, in the event that appropriate, trader approval, which could result in a switch to the newest regards to your preapproval. Preapprovals are not available on every products and can get end just after ninety days. Get in touch with a house Lending Mentor for info.

New NMLS ID was yet another identification matter that is granted by the All over the country Mortgage Certification System and you will Registry (NMLS) every single Home loan Founder (MLO)

Angel Rios

JPMorgan Pursue does not provide tax advice. Delight consult your taxation coach about the deductibility of interest and most other fees.