As we advertised within the Summer, tightened federal lending criteria make it more complicated and more costly to rating mortgage loans getting resource services and next house. At that time, Lender off Utah created a different portfolio home loan – the latest Financial support loan – to keep consumers out of experiencing higher pricing and charges whenever borrowing to have financing properties (properties that are not occupied by the owner consequently they are purchased to make money).

We have been thrilled to declare you to definitely, into the July 6, i and extra the second Financial getting users seeking to a financial having an additional domestic (property, generally speaking a vacation house, this is simply not stayed in full-time but is not used in rental earnings objectives).

We’ll talk about the new funds in detail, however it would-be better to discover whenever we basic establish the fresh federal changes one caused Lender away from Utah provide all of them.

New Federal Rule: Told me

In the , the new You.S. Department of your Treasury and Government Housing Loans Institution (FHFA) launched an amendment on Popular Stock Purchase Preparations involving the Treasury and you will each other Fannie mae and you can Freddie Mac. This new amendment implemented a cap toward number of money spent and you may 2nd mortgage loans Fannie and you may Freddie (one another government-sponsored agencies, or GSEs) can find about nation’s mortgage brokers.

Essentially, this means that mortgages secured from the financial support characteristics and you can second property usually do not meet or exceed eight per cent of one’s full regularity that is sold towards GSEs of the any one financial. Before, there have been zero limit.

With respect to the FHFA, new amendment ensures that Fannie mae and Freddie Mac’s team factors is in keeping with the goal to support homeownership. But what performs this suggest for real home buyers and you may consumers?

This new Federal Laws: Exactly what Individuals Would like to know

With the organization of your own eight percent cover, loan providers can’t be particular they will be in a position to sell https://elitecashadvance.com/payday-loans-tn/ every one of its investment property and you will 2nd lenders so you’re able to Fannie mae otherwise Freddie Mac. Whenever they cannot promote, of a lot loan providers could well be obligated to both slow down the quantity of fund they originate or move the cost on to consumers regarding brand of even more costs and you can/or maybe more rates.

Among the most effective financial institutions regarding the You.S., with more than $2 mil inside property, Lender out of Utah enjoys the means to access portfolio finance and you may funding, and certainly will remain investment property and you will second lenders in-house in place of sell them on the second sector. This is exactly good-for consumers for some causes:

- The mortgages might be owned by its neighborhood lender.

- They usually have the ability to rating these money, despite the stringent federal signal.

- Might supply access to better interest rates, with the the new Funding and you will 2nd Lenders.

New Financial out of Utah Financial support Mortgage: The way it operates

Our fund is balloon loans, definition monthly mortgage repayments depend on normal 29-year financing terminology, however the financing themselves are owed after fifteen years.

- Buy, refinance and cash out re-finance enjoy

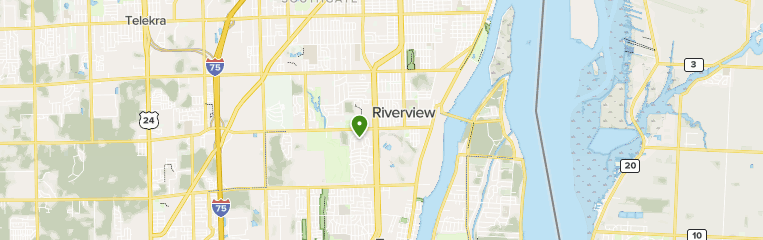

- Designed for funding properties situated in Utah, Washington, Tx, Idaho and you may Las vegas

- Loan amounts out-of $75,000 so you can $600,000

- Specific credit ratings, loan-to-well worth percentages and you may obligations-to-income rates in addition to expected

If you are in the market for a residential property or next household, reach out to a bank away from Utah home loan manager now to go over the loan standards and operations in detail. Our very own standards is similar to Federal national mortgage association and you may Freddie Mac’s, plus some cases, Bank off Utah may even bring most useful rates by keeping the mortgage internally unlike attempting to sell they.